Before Contracting To Sell Final Expense Insurance

Things to know before contracting to sell final expense insurance!

Should You Sell Final Expense Insurance as An Independent, or As a Captive Agent

The Rewards of Helping People Who Need Final Expense Insurance

Our industry is one of the easiest to sell

Face to Face or Telephone Sales

How to Sell Final Expense Insurance With Leads

Underwriting Final Expense

Contracting Through a Good IMO

What Happened to Health and Medicare Sales

Sell Final Expense Insurance Because It’s An Easy Cross Sell

One Call Closing Therefore Saving Time and Money

Where should I start?

If you’re going to sell final expense insurance, you have 2 main options. The first is to sell final expense insurance as a captive agent. As a captive agent, you should only have to learn one product. You should also have access to a local office to go to. The idea is to have a place to go on a daily basis for training. It’s also nice to have a home base so you can socialize with other agents, on a regular basis. This creates synergy. The negative thing that always comes up with being captive, is that your commissions will likely be very low and totally capped. You’re also not likely to sell a very competitive product. If you’re not selling competitive products, you will see a lot of your sales being replaced.

A second option is being independent! This is actually a better scenario for most people that want to sell final expense insurance. To start as a captive agent, you have to be a very focused individual. You’ll need to have the ability to learn and work on your own. This makes it more difficult as you have to commit without being managed or pushed by someone else. Most people don’t start to sell final expense insurance as an independent agent, but end up transitioning from being captive. There are some major benefits to being independent. The commission levels as an independent are often double of those who are captive. You also have access to lots of competitive carriers with multiple health niche scenarios. I carry around a cheat sheet with 10 different final expense products and their niche’s.

Can I sell final expense insurance over the phone?

If you’re going to sell final expense over the phone, the odds of you succeeding are extremely low. Unless you work in a phone room with other agents! My experience with selling over the phone was short lived. The main think I learned is that these folks don’t stay on the books very well. They also tend to change their mind as soon as they get the policy. This means you can easily end up in charge back hell, as soon as you get into the business. If you’re working in a phone room, you have a better chance for success as there is synergy between you and your peers. Comradery makes a difference, as your group can push and help each other to work as a team. This form of workmanship tends to be a game changer for most agents that sell final expense over the phone.

An agent selling final expense insurance over the phone while working alone, tends to be on a deserted island. This alone can be a recipe for disaster. Not that selling face to face as an independent is much better, but it is! It’s hard to work from home because of the distractions and the loneliness. When you’re a field agent, you are out and about, meeting new people. You also have a much better grasp on your clients and can do more for them. When they change their mind about taking the insurance, you can go knock on their door and save the sale. When there is a problem with their billing, you can go fix that in person too! Our clients are not the most financially dependable folks because they are on a fixed income.

Any suggestions for contracting and leads?

There are lots of IMO’s for an agent that wants to sell final expense insurance to work with. Just make sure you do your research first, or you may end up a hostage with the wrong company. You have plenty of IMO’s to chose from and find one that fits you the best. Some of these companies have lots of carriers and multiple lead sources, but no real training program. Other carriers have great leads but are limited on carriers and offer low commission levels. There are even companies that offer amazing training but don’t really have good lead sources or decent commission levels. If you’re going independent, there is no reason for your commission levels to be less than 100%. You should also have access to multiple leads and a good training program.

Do your due diligence. There are plenty of places to look for decent final expense IMO’s, an almost unlimited amount of competitors. Try using Google. You can Google keywords like Final Expense Training, Final Expense Sales, or Final Expense Agents. Simple Google keyword searches will pull up several IMO’s that are “liked” by Google. Another great way to find final expense agencies is to use YouTube. You can go there and just put in a keyword like Final Expense Sales IMO and plenty of videos will pop up. There are also places like Ripoff Report where you can do research on any IMO that you are considering contracting with. If someone is really unhappy, they will go there and report on a company, thus you’ll see the dirt along with potential false claims. You’ll have to decide what is justifiable and not.

Aren’t the leads expensive?

The strongest lead in our industry is the direct mail lead. They cost between $27 and $40 each, depending on the verbiage of the card and the vendor. Seniors fill these cards out and stick them into the mail, therefore this is the best lead for door knocking. Direct mail leads are easier to generate in a smaller population and great if you want to work locally. All of our top producers work DM leads. They get a fixed amount, 20-40 leads per week. This guaranteed plenty of activity as they have lot’s of prospects to see.

Another great option is the telemarketing leads. TM leads can go from $7 to $30 each depending on the quality and the vendor. These leads are generated from a variety of callers. Some callers are located in the US but most are based in other countries. The callers accent has a lot to do with the quality or the leads. So does the verbiage of the caller’s script! We have telemarketing leads for as little as $9 each and yes, our TM leads are high quality. Vendors sell a similar lead for $18 to $28 each. Data is limited with this type of lead and you will likely want to mix DM leads with your TM leads for better results.

What about Facebook leads?

Facebook leads are getting more and more popular. The quality is usually about the same as a direct mail lead but is often better. The shelf life isn’t as good as the DM leads but you can usually get FB’s immediately. Just turn on the ads campaign and you can have leads within a couple of hours. Because data for this type of lead is limited, don’t expect to work them on a regular basis. Like the TM’s, there just isn’t enough people on Facebook to be able to get a fixed amount. At least not on a weekly basis, and in your own back yard! Traveling is necessary if you are going to attempt to make this your primary lead.

Again, these leads are great to mix in with your DM and TM leads. Most IMO’s are either offering these type of leads or experimenting with Facebook. For those of us that know how, generating them is pretty easy. We simply work with the Google algorithm and place ads on Facebook. The prospect sees the attractive ad and clicks on it. They are then taken to a landing page. If they fill out the form on the landing page, you have a lead. Most companies have a hard time creating an effective landing page. Through trial and error, we found out that the landing page is extremely important and will make or break your ability to generate this lead. Yes, our agents have access to Facebook leads too!

What’s the best way to work a Facebook lead?

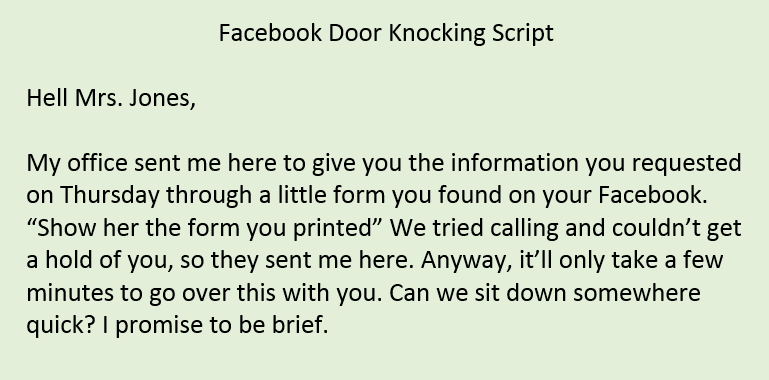

There are a few tricks to working the elusive Facebook lead. First, it’s important to contact the lead as soon as possible. The shelf life is not good and we find that it’s better to get in front of the prospect as soon as possible. A few hours can make a big difference. If they don’t answer the phone, try texting them. Yes, this sounds like a counter productive way of working the lead, but a short text can help you to get on the phone with that prospect. Then you can go to setting the appointment, immediately! If you can’t get them on the phone, door knock the lead. My experience with door knocking this type of lead has been really positive.

When you door knock Facebook leads within a couple of days, they will remember filling out the online form. Smoothly let the prospect know that this will be really quick and that you are not going to pressure them into anything. They will let you in if you’re good. Now all you need to do is make your presentation and find an amount of insurance that they can afford! It’s not very hard to sell final expense insurance to these people. My experience with Facebook leads has been very positive. When generated correctly, they can be a really strong lead. There is only one problem. We just can’t get enough of them! I have attached a couple of important things below. A training video on overcoming objections while door knocking leads and my Facebook lead, door knocking script!

What is the typical day like, for a FE agent?

Agent’s that sell final expense have 2 types of days. Field days and phone/client service days! On field days we do a lot of door knocking. If you’re new, you’ll probably want to door knock all your leads. I like to call and set appointments. Then door knock in between! This is usually the best way to get the most out of your time and leads. You’ll also be going back to save cancellations and help clients that need to make changes with checking accounts, beneficiaries, etc. Doing this type of service work is a big part of our business. It can be rewarding. The more time you put into helping a client, the easier it will be to get referrals out of them. If you’re going back to someones house to help them with their policy, they will usually appreciate this and recommend you to their friends and family.

On phone days you are setting appointments and servicing your clients. We do a lot of paperwork. Even the guys that use E-Applications have to do it. If you’re not good with people or paperwork, you might not want to enter our industry. I just say this because there are times when the service work feels overwhelming. The clients tend to call for various non insurance related information, too. Some clients will change their beneficiary at the drop of a hat. My wife Mariana has a client that has changed beneficiaries 3 times now. Yes, this lady is on her 4th beneficiary. Our clients can’t all be level headed.

Where can I go for the complete package?

It’s important to have access to the right carriers and good lead programs. The one thing that I can say about United Final Expense Services Inc, is that we have everything a licensed agent could want, in order to increase his or her chances for success. Having commission levels between 100 and 120% will make it easier for you to be successful. Access to multiple lead options can be a game changer too. Between the higher commissions, all the top final expense carriers, multiple lead program, and our extensive training, the only way for you to fail is from a lack of work ethic. Sadly, we see a lot of the same people fail with us, that couldn’t make it with 50% commissions. Determination, hard work, and a “will not surrender” attitude are necessary in our industry thus, you must be ready to work very hard.

We have one of the most intensive sales training programs in the industry. Our program consists of weekly assignments designed to teach you each topic, fast. We have a collection of training videos you can log into and view. Our training will teach you the ins and outs of our industry. You’ll learn how to make a strong presentation, overcome objections, close more sales, and make sales where the last agent couldn’t! Think about it! When you add in our training videos to our weekly training calls, you’ve got everything you need to be successful. You will also have access to your very own final expense trainer. Having someone to call for help can be the difference in your success, and failure.

What about carriers and commission levels?

In our industry, having the right carriers is very important. We do several replacements on a weekly basis therefore, having specific carriers for different niche’s is extremely important. I walk into a lot of situations where the prospect was sold a graded or guaranteed issue product. In a lot of cases, this was not necessary. With the right products, you will be able to save these folks money and give them first day coverage. We make sure that our agents have our 10 carrier niche sheet with them at all times. If they can’t find the niche there, they can always call us for an underwriting assessment. There are a lot of replacement opportunities out there. All you have to do, is get in front of enough people and know what to do.

We start our agents with very high commission levels. First year commission levels start between 100 and 120%, even for newly licensed agents without proof of pruduction. With production, you can get higher, therefore we give you the ability to grow. Personally, I believe that you should make top dollar for each of your sales consequently, having no excuses for failure. We make it easy for you to sell final expense insurance and make six figures doing it as long as you have the determination for success. If you want to sell final expense insurance as an independent agent, you will not find a better place, than with us. Our primary purpose is to make sure that our agents have the highest chance for success therefore, we have several top producers.