How to Design and Make A Final Expense Sales Presentation

The Final Expense Sales Presentation

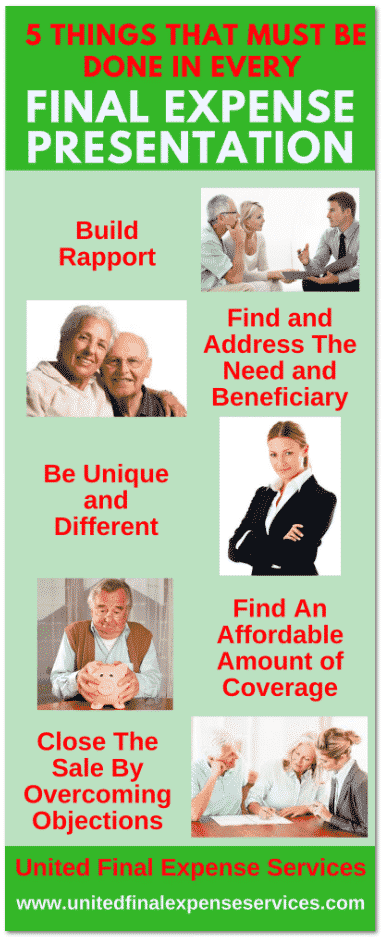

There are a variety of ways that you can deliver an effective final expense sales presentation. I’ve noticed that every IMO teaches a different presentation style based on what they have seen work in the field. They’re all pretty effective, depending on the presenter or course. The hard part is for you to figure out how to put together a presentation that fits you and is easy to make. Hopefully, this blog article will give you the direction that you need. When it comes to making a final expense sales presentation, the last thing you want is to miss the target and end up looking week or ill informed. Follow these tips and you’ll do just fine.

Here’s what we’re going over today

The importance of using energy and enthusiasm

When and how to address the need for the insurance

How to make your final expense sales presentation unique

Field Underwriting

Some suggested carriers for new agents

Using a cheat sheet during field underwriting

Using a medical questionnaire

Pricing for the need verses the cost

How many options to show during the final expense sales presentation

How to close the sale

Overcoming objections during a final expense sales presentation

Doing a POS interview verses no interview

Making sure you don’t forget something before you leave the prospects home

How to do a warm up

When I was first licensed, one of the things that concerned me was all this talk about doing a warm up. Unfortunately, I was not the best at small talk. Building rapport though a warm up was not going to be easy for me. Thankfully, I was taught that with the right presentation, the warm up would happen naturally. This worked for me for years. Keep this in mind. When you make a strong and clear presentation, you will have less objections to overcome during your close. The prospects will sense that you are knowledgeable and this alone, will make it easy for you to build some “natural” rapport. As time goes by, it will be easier for you to build rapport just by being yourself.

Until then, here is what I suggest. When you enter the prospects home, simply look for things to talk about. The most obvious thing is photographs. Don’t be afraid to ask questions. Most of our senior prospects, love to talk about their family. Especially if it’s someone they really love! Getting them to brag on their grandchildren is usually easy. At this point, you can always talk a little bit about yourself or pull out your flip book and show them photos of your family. This is a great time to add in your personal commercial too. A personal commercial is simply a short introduction about yourself as to how and why you help seniors with final expense life insurance. Here’s a great video on designing a personal intro/commercial that you can use to build rapport and break the ice.

Excitement, energy, and enthusiasm during your final expense sales presentation

I want you to consider something. If you are sitting on the couch with a salesman. He is attempting to sell you something that you are interested in but not sure if you really need it. While he makes his sales presentation he is monotone. He is not using much energy and is difficult to follow. You are getting bored and starting to wonder how much longer this will take. You’re thinking to yourself, “wow, this dude is really unprofessional”. Or you start to nod off! Then you start to take a closer look at him in order to find more imperfections. Yes, this is what naturally happens when you are belly to belly with a boring salesman.

Now consider this! You are making a very solid and professional presentation. During your presentation you appear to enjoy what you’re going as you’re emitting lots of excitement and enthusiasm. You have strong/positive body language and are using your hands to emphasize key points during the final expense sales presentation. You’re keeping your energy level up and making it easy for the prospect to follow you. When you speak and are nodding your head “yes”, the prospect is following you and nodding their head “yes” too. Everyone is in agreement because your energy is contagious. This is why it’s extremely important to use energy, excitement, and enthusiasm during every one of your presentations. Also, make sure to keep that energy level up, right down to when you’re closing the sale.

Addressing the need

It’s important to address the need for the insurance, every time you make your final expense sales presentation. Most of our agents address the need by going over the “3 reasons that people speak with me”. This is the foundation of many final expense presentations, including the one that I make. An effective “3 Reasons” presentation will have your prospect telling you why they are interested in final expense life insurance. See the image below for exactly what I say during my “3 reasons” introduction. During this part of the presentation, you will also find out who the person is that will end up taking care of your prospects burial or cremation and be stuck flipping for the bill. This persons name is extremely important to have.

Once you have the name and relationship of the beneficiary, you will be able to use their name throughout your presentation. By bringing their name up during key points of the final expense sales presentation, you’ll find it easier to close more sales. In my experience the more times you bring up the beneficiary during your presentation, the better. Hitting on that name 4 or 5 times can only help you when it comes time to closing the sale. The idea is to keep reminding the prospect of the need for the insurance during the entire presentation and when you are closing the sale.

Separating yourself from the other insurance agents

Everyone makes their own unique presentation, therefore no two final expense presentations are the same. The trick is to make your presentation special by separating what you’re doing from what all the other life insurance agents are saying and doing. This can be done by making a strong presentation added to an explanation of how you work as a broker. The trick is to not use the word “broker” and to let them see that you have access to a lot of competitive carriers. Here’s a tip. Instead of saying “I’m a broker” say “I’m part of a group of senior advocates“. This alone, can makes you appear more attractive. Statements like this are outside the norm and our prospects are not used to hearing from life insurance agents.

Consider explaining to your prospect, how all the insurance companies are different and that none of them have the same rates or health underwriting criteria. During part of my presentation, I like to address how the insurance companies all have their little niches and ways that they beat other insurance companies. By finding out the prospects health issues, we can find the best carrier, based on their health. In most cases, we can give them first day coverage, even though they have multiple health issues. During this part of my presentation, I explain how I couldn’t do this back when I was a Hartford life insurance agent. By incorporating this into your final expense sales presentation, you will be able to separate yourself from the crowd.

Field Underwriting

The field underwriting aspect of a final expense sales presentation is always the most difficult to learn. It takes diligence and patience. Unfortunately, this never was one of my strong points either. Thankfully, if you use the steps that I have outlined below, you will likely be just fine

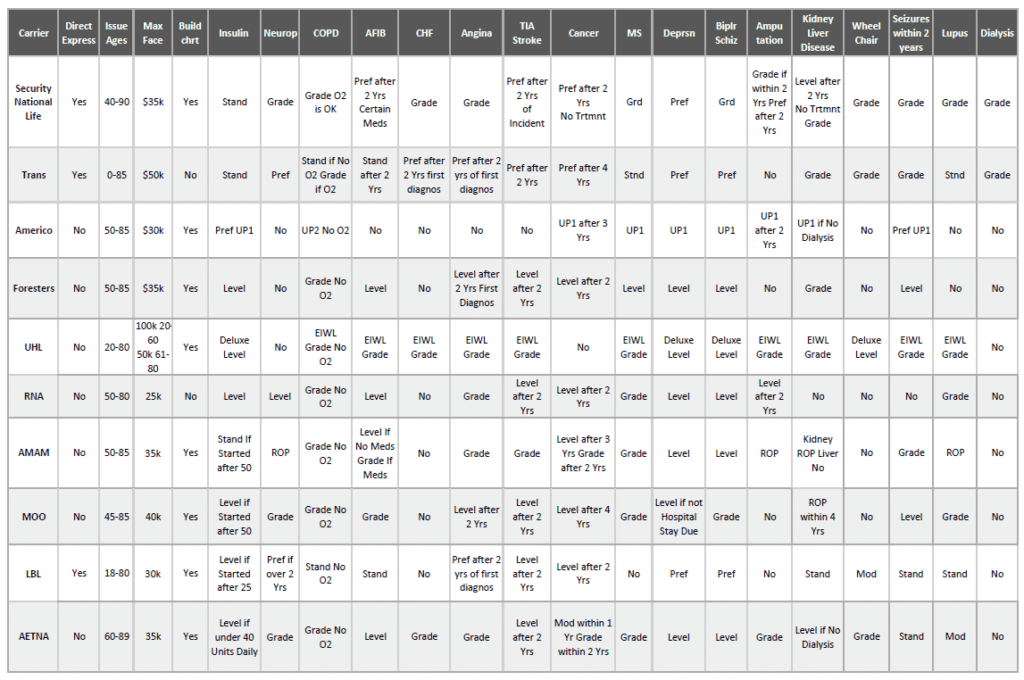

First – Always have the medication guides and knockout lists for each product, with you. Don’t be lazy. When the client pulls out their medication list, make sure you know how the carrier views each medication. See cheat sheet below. Some changes may have occurred with underwriting for some carriers as this cheat sheet is from mid 2017.

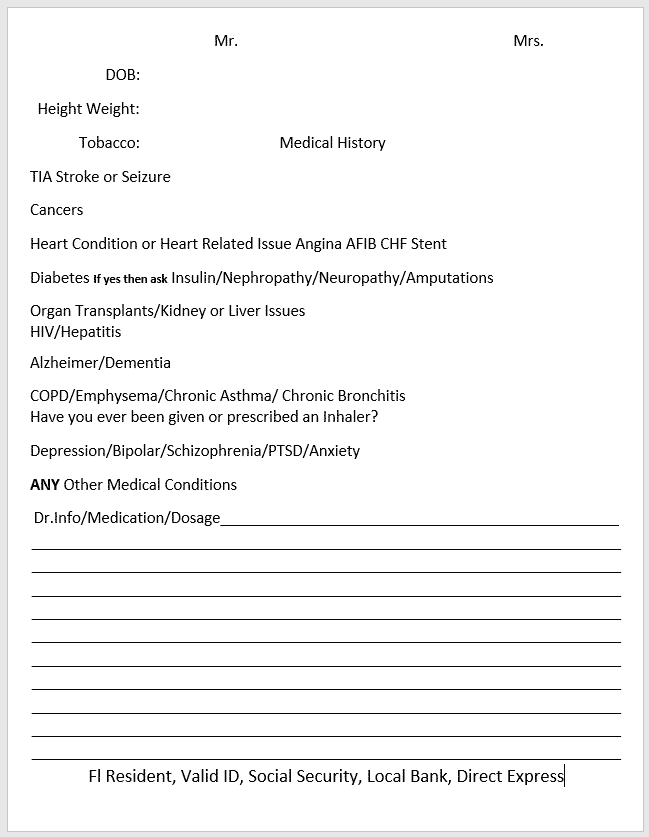

Second – Use my medical questionnaire. If you ask all the basics on this list, you’ll pretty much cover everything. Add that to the medication they have taken over the past 2 years, and you will get a nice picture of what they have. This will guide you to choose the right carrier based on their health. Have your smart phone handy as you can always use Google.

Third – Lead with a point of sale carrier. When you use a Point Of Sale carrier, in most cases you’ll know if your client is approved before you leave their house. This will keep you from going back and forth to their house. If something comes up during the background check, you can easily switch gears and try a different product. It’s better to take care of this while you’re with your client instead of coming back later. FYI Security National Life has an E-Application that give you the underwriting results before you leave the client’s house.

Check out the video below “How to Field Underwrite Like a Seasoned Pro”

Using a cheat sheet during your final expense sales presentation

A good cheat sheet has a list of all the carriers that you are working with along with the most common health conditions that we see in our industry. The person or agency that is teaching you the final expense sales presentation will have something like this. If not, you are probably with the wrong IMO as a cheat sheet is a very basic necessity in our business. If they don’t have one, you may be in trouble. This is a strong sign that they may not have adequate knowledge of our market and how to effectively work it. Also, your cheat sheet should have the most competitive carriers and their niches. A cheat sheet with 3 overpriced products is not going to do much for you. The idea is to leave the client with the best product based on their health.

Some of the most common ailment are high blood pressure, insulin use for diabetes, diabetic neuropathy, and chronic obstructive pulmonary disease or COPD. You will also see a lot of folks with multiple mental health conditions, heart conditions, history of strokes or seizures, HIV and Aids, and cancer. If you’re thinking that you probably can’t insure people with these conditions, you’re wrong. With the right carriers, you can give people first day coverage for “most” of the above health issues. Aids and Cancer are going to be guaranteed issue only. Thankfully, there are some competitive GI products out there. My favorite GI carrier is Gerber Life. Everyone knows them so they carry strong brand recognition. They are also priced better than most of the competition. FYI, contact us here if you would like this product as we offer their highest commission level.

Using a medical questionnaire

With a good medical questionnaire, you will be able to get a general ideal of your prospect’s health issues. Once you know their health issues, you will have a better idea of the carrier and product you want to apply for. I also like to use the questionnaire to figure out what form of payment the prospect will be using. This is important as a lot of seniors on fixed income do not have a checking account. There are 3 final expense carriers that take Direct Express. Contact us here if you would like their highest first year contract/commissions. There is also 1 carrier that will take debit or credit cards. Thankfully, they are one of my favorites. Check out the medical questionnaire that I use in my final expense sales presentation, below!

Pricing for affordability verses pricing for the cost of the funeral/cremation

There are 2 takes on how to price out options for a final expense prospect. A lot of insurance agents like to talk about the cost of the funeral or cremation. The cost of funerals and cremation is brought up and concentrated on during this type of presentation. The agent shows a chart similar to the one below that shows the average funeral cost. When the agent prices out the monthly payment options, they’ll show an amount that should cover all the funeral costs. They will also price out an amount to cover a basic cremation and everything in between. During the presentation the agent does other things to justify the monthly payment. I don’t like this type of final expense sales presentation for 2 main reasons.

- If the client want’s a funeral and they are older, you might be showing them something that is way out of their range. Now that they can’t afford the funeral, they will use it as an excuse to do nothing. This does nothing to help the client’s family after his demise.

- By doing this you are often showing them a bottom option that is super cheap, like $17 a month. Most of our low-income seniors will naturally go to the bottom option and now you just sold them an option where they could have afforded a much higher premium. This leaves the door open to other insurance agents that are potentially replacement artists.

Pricing options that our prospects can afford

This is what I do during my final expense sales presentation and what we teach our agents to do. It is important to find an amount of insurance that the prospect can afford. My making a presentation that does this, you are always concentrating on their budget. By doing this, you should have less cancellations and keep a higher persistency and placement. If the client bites off more than they can chew, they will cancel. Now you’re going back to their home to resell them an option that you probably should have sold them the first time around. Trust me. You want to limit the amount of times you drive back and forth to your client as this will get old quickly!

This is why we make a presentation that is centered on affordability. I don’t show any sales materials that breaks down the costs of a funeral and I don’t make a big deal about how the cost of funerals is exploding. During my final expense sales presentation, we will casually bring up the costs. I let them know that I was told by a funeral home owner that the cost of funerals and cremation will likely double every 10 to 15 years. If the prospect appears to be well off financially, and insists on a funeral, I want to be prepared to overcome their objections during the close. At that point, I can get into detail the costs of funerals and show them a breakdown sheet that I carry with me. Here’s an example showing some of the costs of funerals.

Closing the sale

During the close, I like to show the prospect 5 options. We suggest showing the maximum amount of coverage, all the way down to an option that is at least $50 a month. If I think they can afford more, I might show them a “bottom” option that is around $80 a month. There is no reason to show someone who’s fiscally responsible and obviously has no affordability issues, anything lower than this. If you do, you will be underselling and leaving yourself open for more insurance agents to come in behind you. Your sale will be replaced as another agent will likely show them a good deal on more insurance. Trust me on this. The only agent that should be doing any life insurance replacements is you.

The best way to overcome objections during your final expense sales presentation, is to have a strong presentation. Try to come off as being very knowledgeable about our industry and the costs involved. You’ll also get fewer objections if you are clean cut, well groomed, and act like a pro. I do suggest that you learn how to overcome objections before making your first presentation. Have a few canned answers ready to go. As a new agent, you will find it easy to go from giving your canned reply, to doing your price drop close. If your presentation is strong, the prospect likes you, and you come off as being professional, it will be easier to push your prospect into an affordable option, even if they give you an multiple objections. Just make sure to always be prepared. Remember, the more prepared you are, the better.

Formula for overcoming objections during the final expense sales presentation

1. Address the objection with common sense. Let the prospect know that you know that it’s natural for them to have excuses “not” to buy the insurance but you’re there to help them.

2. Bring up the need for the insurance along with how their loved ones, “name of beneficiary” is going to be stuck having to deal with everything.

3. Do a price drop close. You must be able to “smoothly” show a smaller option if necessary, and push the prospect into that option without being too pushy!

If this doesn’t help, then address the real objection which is often that they don’t trust you. I bring up how I have never had anyone complain that their parents or loved one had the insurance and that I hear a lot of people that are upset because their family did nothing to prepare for the inevitable outcome that we all will see.

Share a little story about how you sell final expense to help people. Let them know that you could be find and lose your license by lying to them. This is when I show them my license and let them know that my license is what feeds me and the family, and that I would never do anything to endanger them. I show them my drivers license and let them know that I am just an everyday guy. I like to point out my address on the ID, so they know I have nothing to hide. This is when I go back to doing another price drop close.

Should you lead with a “Point of Sale Carrier”?

If you’re a new agent, you should absolutely be using a carrier that does a point of sale interview. As I mentioned earlier, by doing this you will know before you go and will save yourself the trouble of having to go back and forth to your client’s house. Most seasoned agents will lead with a carrier that does too. If you can get your client qualified before you leave their house, then you have a win-win scenario. Not only do you know before you go but the POS interview also helps you to lock in the sale.

If you’re a talented field underwriter, and know a lot about our market and field underwriting, you can easily do what I do. I have streamlined my final expense sales presentation to include the use of a Non-POS carrier to lead with. This makes it easier for me to get in front of more prospects and make more sales in one day than your typical final expense agent. We teach our seasoned agents how to do the exact same thing and have agents writing $20,000 and even over $30,000 each month. This is an advanced sales method. Warning! By using it, you can easily have a lucrative/6 figure income. If you try to lead with a Non-POS carrier and are limited in your field underwriting expertise, you could end up in debt.

Check out our carriers page as the 2 videos can point you in the right direction of carriers that do the interview and carriers that don’t require the point of sale interview.

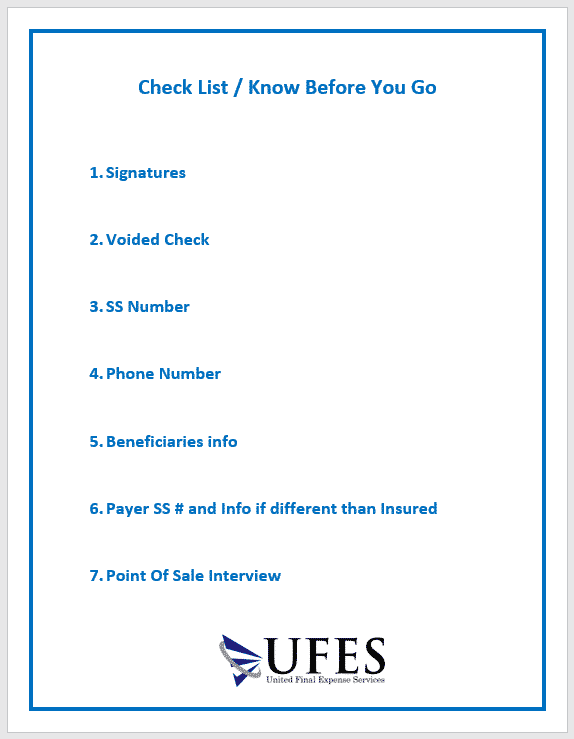

Reminder Check List

We recommend that you print out the page below, and put it in your sales book. Once you’ve made your final expense sales presentation, completed the transaction and are ready to leave your client, go over this check list. Make sure you have done everything as this may keep you from forgetting some of the things that I have forgotten. Remember, the last thing we want to do is go back and forth to our clients house. The more times you have to go back for something you forgot or for some additional requirement, the more likely your client will get buyers remorse. When everything goes smooth and easy, it’s easy to get referrals during your policy delivery.

Feel free to contact us or email Doug at doug@ufesonline.com with any questions that you may have in regards to our final expense sales program. With access to advanced sales training, high commission, and multiple lead programs, your chances for success are pretty darn good. Don’t cut yourself short by being afraid to invest into a strong lead program either! Remember, if you have a sales background, you could do very well in our industry. Anyone with a strong work ethic can have a very lucrative career in final expense sales. Good luck and happy hunting!